Extracting the trend of a time series is an important

analytical task as it simply depicts the underlying movement of the variable of

interest. Had this so-called long term component known in advance, we would

have been able to foresee its future course. In practice, however, there are

several other factors (e.g. cycle, noise) in play that have influence on the

dynamics of a time dependent variable.

Time path of a variable can either be deterministic

(assuming the change in trend is constant) or stochastic (assuming the change

in trend varies randomly around a constant). Estimation of a deterministic

trend is straightforward, yet it often oversimplifies the data generating

process. The assumption of stochastic trend seems to be a better fit to

observed behavior of various time series as they tend to evolve with abrupt

changes. Nevertheless, its estimation is difficult and can have serious

implications due to accumulation of past errors.

Kim et.al. (2009) proposed l1 trend filtering method, which produces trend

estimates that are piecewise linear. In this method, changes in slope of the

estimated trend can also be interpreted as abrupt changes or events in the

underlying dynamics of the time series in question.

EViews add-in "l1filter" implements the primal-dual

interior point method1 outlined in Kim et.al. (2009). The add-in is designed to work in series object and

can also be run from command line. In that respect, it is similar to “hpfilter1s”

add-in. For details, please see the information in the documentation that comes

with the add-in.

l1 trend filtering method can also be

thought of as a segmented linear regression, where we fit a straight line on

each segment. Note that this is different than the approach of breakpoint

regression as the latter does not necessarily have consistent values at the

join points.

The use of add-in is demonstrated below on a different data

set than that of Kim et.al. (2009) in order to avoid slow computing time2.

Instead, a low frequency macroeconomic time series data is chosen for the

purpose: Monthly Industrial Production Index (2010=100) of Turkish Economy

between January 1986 and August 20163.

Import the data into EViews4:

import .\tripi.xls

range=mevsim_1986!$B$5:$N$37 byrow colhead=1 namepos=all na="#N/A" names=(, , , , , , , , , , , , ,

, , , , , , , , , , , , , , , , 2013, 2014, 2015, 2016) @freq U 1 @smpl @all

Restructure the workfile:

pagestack num? @

*? *

pagestruct(freq=m,

start=1986, end=2016)

Get rid of unnecessary series:

delete id01 series01

var01 year

Change the name of dependent variable:

rename num ipitr_adj

Plot the series:

ipitr_adj.line

Estimate a deterministic trend:

equation eqdet.ls ipitr_adj c @trend

Visualize the fit:

eqdet.resids

Estimate a stochastic trend (i.e. Hodrick-Prescott filter5):

Estimate l1

trend:

Ipitr_adj.l1filter(trend=trend_l1,lambda=100,draw)

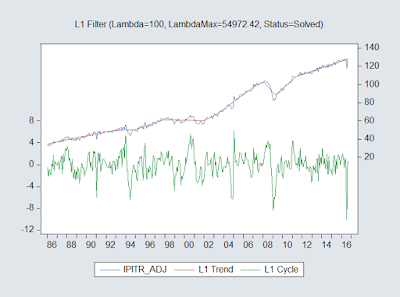

Note that in addition to the penalty parameter the chart

title also includes the maximum lambda value that would produce a straight line

(i.e. affine fit) as well as the resulting status of iterations.

We can compare two estimated trends:

graph graph_comp.line trend_hp trend_l1

graph_comp.draw(shade, bottom) 2008m01 2010m12 'shade the period of interest

Please note the relatively smooth transition behavior of

HP filter around the global financial crisis of 2008 and the V-shaped recovery

pattern captured (more accurately) by l1 filter.

l1 trend is also more robust to

end-point sensitivity:

smpl @first 2016m07 'drop the last observation

ipitr_adj.hpf(lambda=14400) trend_hpb

ipitr_adj.l1filter(trend=trend_l1b,lambda=100)

line trend_l1-trend_l1b trend_hp-trend-hpb

smpl @all

Another useful practical application of l1 filter is the identification of breakpoints

(i.e. kink points) for a given time series as it has the ability to estimate

piecewise linear trend, where the consecutive segments have consistent values

at their join points. EViews already allows breakpoint estimation, which does

not require such consistency when used in the identification of breaks for the

time series of interest. Although Bai and Perron (2003) make some

very useful and practical recommendations, deciding the number and type of

breaks is still an art as much as a science. In this case, global maximization

approaches seem to work better as they are able to identify important turning

points more successfully (with a margin of error, of course) in the history of

Turkish economy6:

equation eqbreak.breakls(method=globplus1,trim=5,size=1,heterr)

ipitr_adj c @trend

string breaks = eqbreak.@breaks 'save the dates of breakpoints

Visualize the fit:

eqbreak.resids(g)

Save the fitted values:

eqbreak.fit trend_break

We can compare the results from both analyses:

line trend_break trend_l1

l1 filtering is a

useful tool for both trend estimation and breakpoint detection of a time

series. Although the add-in can only be used for such purposes only, the

interior-point method developed by authors can be extended to handle the

problems in areas like; univariate time series decomposition, outlier

detection, regularized least squares, multivariate time series analysis, etc.

References

1 Please visit authors’ web page for details: http://web.stanford.edu/~boyd/papers/l1_trend_filter.html

2 The original algorithm exploits the sparse matrix structure, which EViews does not have that functionality (yet).

3 Officially adjusted for calendar and seasonal effects: http://www.turkstat.gov.tr/PreTablo.do?alt_id=1024

4 You can download the data from: http://www.turkstat.gov.tr/PreIstatistikTablo.do?istab_id=2418

5 In order to reflect the usual practice in macroeconomic time series modelling, default value of HP filter is preferred here (Hodrick and Prescott, 1997). In the original study, however, authors used the same lambda for both L1 and HP filters. Difference in the results would become much more pronounced if we did so.

6 Turkey experienced major economic crises of domestic nature in 1994 and 2001. Asian crisis hit Turkish economy during 1998 and not to mention the impact from global financial crisis of 2008. As of end-2010, Central Bank of Turkey announced a new (unconventional) monetary policy for the sake of financial stability and introduced the interest rate corridor framework from 2011 and onwards.

Bai, J. and Perron, P. (2003). "Computation and Analysis

of Multiple Structural Change Models", Journal

of Applied Econometrics, v. 18, pp. 1–22.

Hodrick, R. J. and Prescott, E. C. (1997). "Postwar U.S.

Business Cycles: An Empirical Investigation", Journal of Money, Credit and Banking, Vol. 29, pp. 1-16.

Kim, S-J., Koh, K., Boyd, S. and Gorinevsky, D. (2009). "L1 Trend Filtering", SIAM Review, Vol. 51(2), pp. 339-360.

1 Please visit authors’ web page for details: http://web.stanford.edu/~boyd/papers/l1_trend_filter.html

2 The original algorithm exploits the sparse matrix structure, which EViews does not have that functionality (yet).

3 Officially adjusted for calendar and seasonal effects: http://www.turkstat.gov.tr/PreTablo.do?alt_id=1024

4 You can download the data from: http://www.turkstat.gov.tr/PreIstatistikTablo.do?istab_id=2418

5 In order to reflect the usual practice in macroeconomic time series modelling, default value of HP filter is preferred here (Hodrick and Prescott, 1997). In the original study, however, authors used the same lambda for both L1 and HP filters. Difference in the results would become much more pronounced if we did so.

6 Turkey experienced major economic crises of domestic nature in 1994 and 2001. Asian crisis hit Turkish economy during 1998 and not to mention the impact from global financial crisis of 2008. As of end-2010, Central Bank of Turkey announced a new (unconventional) monetary policy for the sake of financial stability and introduced the interest rate corridor framework from 2011 and onwards.

No comments:

Post a Comment